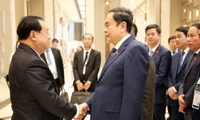

Before the discussion, the NA listened to Minister of Finance Ho Duc Phoc’s presentation of a summary report on the NA’s draft resolution on VAT reduction. Chairman of the NA's Finance and Budget Committee Le Quang Manh delivered a report examining VAT reduction.

The reports said last year, the legislature issued a resolution on fiscal and monetary policies to support the socio-economic recovery and development programme, including a 2% reduction in the VAT for certain goods and services subject to a 10% , effective from February 1, 2022 to December 31, 2022.

Amid economic challenges, the NA decided to continue with VAT reduction from July 1-December 31, 2023.

Phoc said from July-October, the policy provided support totaling around 15.6 trillion VND (650 million USD) for businesses and citizens, contributing to reducing the prices of goods and services, stimulating production and trade, generating more jobs to workers and boosting consumption demand.

The Government suggested that drastic and effective support measures related to taxes, fees, charges, and land rents that have been issued in 2023 should continue while similar support for 2024 should be considered and proposed, he said.

Specifically, a 2% VAT reduction was proposed for goods and services currently subject to a 10% rate, excluding certain categories such as telecommunications, information technology, financial activities, banking, securities, insurance, real estate business, metals, finished metal products, mining products, coke, refined petroleum, chemical products, and goods and services subject to special consumption tax, applicable from January 1-June 30, 2024.

Concluding the discussion, Phoc provided explanations about some issues raised by deputies. He said reducing the VAT is one of many measures to stimulate the economy and effective only in the short term. Therefore, it is still necessary to adopt long-term solutions to boost GDP growth./.